More and more SMEs are exchanging the traditional cash bonus for tax-friendly alternatives. We have already discussed the wage bonus. The profit bonus is another alternative that deserves your attention.

What is the profit premium?

As an employer, you can decide each year whether to grant a profit bonus. The profit bonus is, as the name implies, a bonus that is linked to the profit of the company. Contrary to the wage bonus, the profit bonus cannot be introduced for specific (groups of) employees, but applies to all employees of your company anyway. Individual performance can therefore not be rewarded this way.

Types of profit allowances

However, this does not mean that the amount of the profit bonus must be the same for all employees. After all, there are 2 types of profit bonus:

The identical profit premium

This is a system where all employees receive either the same amount or the same percentage of the salary.

The categorised profit bonus

Should the amount be the same for all employees? No. With a categorised profit bonus, the amount differs on the basis of objective criteria. As with the wage bonus, possible criteria here are seniority, job category, level of education.

Why the profit premium?

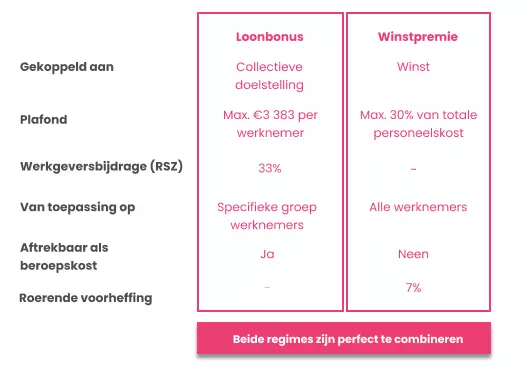

The profit bonus is, after the wage bonus, the most interesting bonus option for an employee from a tax perspective. The advantage of the profit bonus is that the ceiling of the profit bonus is much higher than that of the wage bonus. Whereas the wage bonus is capped at a gross amount of € 3,413, the profit bonus is capped at 30% of the total gross wage bill.

The wage bonus is still the most interesting bonus from a tax point of view. However, the profit bonus is a good option for profitable employers who want to pay out a larger bonus. The combination of profit bonus and wage bonus is also possible.

Is the profit bonus possible for my company?

There are 4 important conditions for the profit bonus:

- Your business must be a company, subject to corporate taxation. Non-profit organisations and public institutions do not qualify.

- The company must make a profit;

- The premium paid (for the whole company together) amounts to a maximum of 30% of the total gross wage bill;

- The premium should be introduced for all workers.

Implementation

The identical profit premium

The implementation of the identical profit bonus is relatively simple. The decision is taken by the ordinary or extraordinary general meeting of the company with a simple majority (i.e. 51%) of the votes.

The minutes of the general meeting must contain the following comments:

- The identical amount or percentage of wages allocated to employees;

- When working with a percentage of the wage: the method of calculating the wage. This means that it must be defined what exactly is meant by the wage: days actually worked, gross wages, bonuses, etc;

- Whether employees are excluded on the basis of seniority. Please note that employees with more than 1 year of seniority cannot be excluded in any case;

- Whether the amount is proportional to the time worked (e.g. the amount of the profit bonus for an employee with a 20-hour week is 1/2 of an employee with a 40-hour week);

- Whether employees who leave the company during the financial year are still paid a profit bonus or not.

The categorised profit bonus

The implementation of a categorised profit bonus is somewhat more complex. This profit bonus is introduced by a collective labour agreement. If there is no trade union delegation in your company, then the profit bonus can be introduced by a deed of accession.

Do you want to share your profits with your employees? Payflip is happy to help! Or do it all by yourself with the DIY tool that Payflip has launched. Still have questions? Contact us!